Ensuring every Aussie can achieve their financial dreams is a passion of mine. Which is one of the reasons why I partnered with Ryan to create Loantec. I’ve held a passion for delivering 5-star service to every client of mine for years, and Loantec allows me to ensure every client—whether it’s through No1 Property Guide, Loantec or The Walters Fund—can get the finance they need, at an affordable rate.

One of my favourite ways of helping my clients is with debt consolidation. My debt consolidation services can help reduce your regular repayments on loans and can give you back control over your finances.

What is Debt Consolidation?

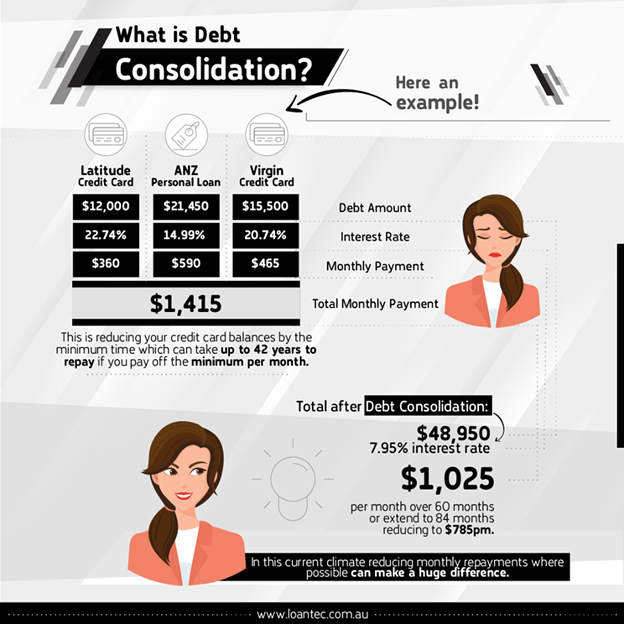

Debt consolidation is basically just putting all your debts into a single loan, generally with a lower interest rate, that puts all your repayments into a single repayment that will (if consolidated properly) be lower than your previous repayments.

This is a particularly good idea if you’re paying off multiple loans or credit cards that have various interest rates and repayment schedules. I’m able to provide great debt consolidation for all my clients because of the relationships I’ve built with finance companies over the years which ensures we have access to some of the lowest interest rate loans around.

Have a look at this example of how I helped a client reduce their payments by $390 a month!

What are the Benefits of Debt Consolidation?

The biggest benefit is also the most obvious, you will be paying less every month. My goal when helping clients with a debt consolidation is to reduce their monthly repayments and give them back their financial freedom.

Aside from that, there are other benefits of a debt consolidation when done correctly. Putting all your loans into a single regular repayment reduces the headache and stress of monitoring and keeping track of several different loans at once.

In many cases, getting all your loans consolidated can also open up new financial options like a car or home loan. Many of my clients have used a debt consolidation to reduce their regular repayments which has then enabled them to qualify to buy a house and land package using my no or low deposit home loan system.

What to Look Out for When Getting Debt Consolidation?

Debt consolidation is a great option for many people, but it’s not the right option for everyone. One of the most important things I ensure my team at Loantec does for every client is to analyse the financials to assess whether a debt consolidation will actually help them.

If a client only has a small debt, or their interest rates are low, there is a chance that a debt consolidation won’t actually reduce their repayments and essentially won’t be worth doing. In these situations, I’ll explain what a debt consolidation will do, or won’t do, and provide them with possible solutions for any financial issues they have—whether that includes or debt consolidation or not.

So it’s important you have a clear picture of what your debt situation is and understand a debt consolidation may or may not work for you.

Along with whether debt consolidation is the right option, there’s also many dodgy lenders and companies out there. After more than 20 years in the finance and property industries, I’ve seen my fair share of companies not following lending policy or providing clients with bad financial advice.

You always want to make sure you’re dealing with a legit company, especially when it comes to your finances. That’s why I’m a big believer in social proof and customer testimonials. Checking the reviews of a company is a fantastic way to understand how they treat their customers and the level of service they provide.

This is why I display reviews for No1 Property Guide and Loantec front and centre on Facebook and Google.

If you’re talking to a company about debt consolidation, or any financial help, make sure you ask for their credentials. If they aren’t able to provide you a license or proof they’re qualified to be providing you financial advice, you should back away instantly.

Some other red flags to watch out for are rushed dealings, being asked to sign blank documents or even not being told what the fees and charges are.

I believe in complete honesty and transparency from start to finish. Which is why, when you deal with me or my team, you’ll know all of your factual options straight away, as well as the benefits and downsides of any decision you make.

Getting finance shouldn’t come with all those risks, which is why I founded Loantec. My aim is to provide the best financial services possible, while maintaining honest, upfront transparency to all of my clients.

Whether it’s debt consolidation, personal finance or a home loan, Loantec and my team of dedicated finance specialists are equipped to handle any situation.

Kind Regards,

Darren Walters

TOUCH BASE: